Average accounting profit is the arithmetic mean of accounting income expected to be earned during each year of the project’s life time. Average investment may be calculated as the sum of the beginning and ending book value of the project divided by 2. Another variation of ARR formula uses initial investment instead of average investment. The accounting rate of return (ARR) is a simple formula that allows investors and managers to determine the profitability of an asset or project. Because of its ease of use and determination of profitability, it is a handy tool to compare the profitability of various projects. However, the formula does not consider the cash flows of an investment or project or the overall timeline of return, which determines the entire value of an investment or project.

Create a Free Account and Ask Any Financial Question

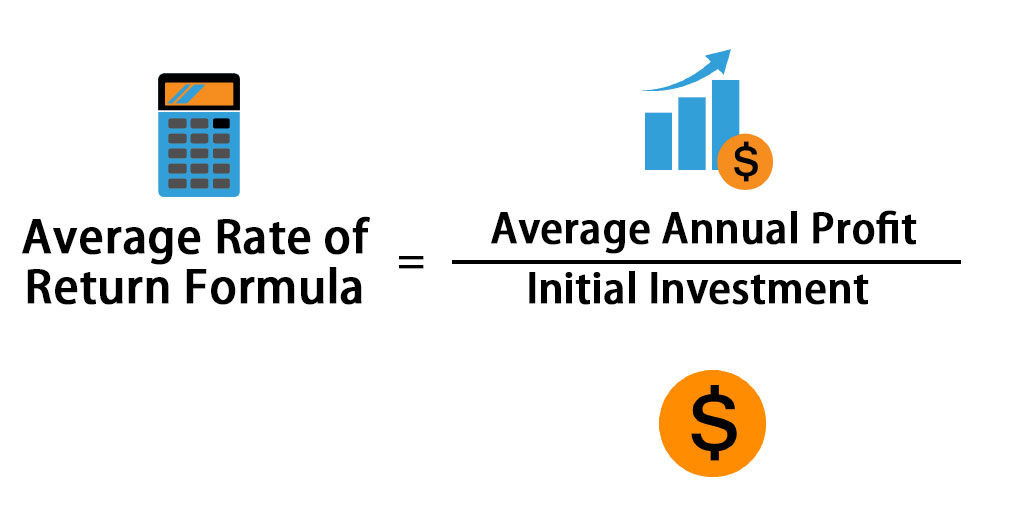

As well as to assist in making acquisition or average investment decisions. The Accounting Rate of Return formula is straight-forward, making it easily accessible for all finance professionals. It is computed simply by dividing the average annual profit gained from an investment by the initial cost of the investment and expressing the result in percentage. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. As we can see from this, the accounting rate of return, unlike investment appraisal methods such as net present value, considers profits, not cash flows.

How to Calculate ARR (Accounting Rate of Return)?

Accounting Rate of Return is a metric that estimates the expected rate of return on an asset or investment. Unlike the Internal Rate of Return (IRR) & Net Present Value (NPV), ARR does not consider the concept of time value of money and provides a simple yet meaningful estimate of profitability based on accounting data. The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow. In the above formula, the incremental net operating income is equal to incremental revenues to be generated by the asset less incremental operating expenses.

Accounting rate of return method

Ask a question about your financial situation providing as much detail as possible. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

If the question does not give the information, then use the average investment method, and state this in your answer. Here we are not given annual revenue directly either directly yearly expenses and hence we shall calculate them per the below table. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Accounting Rate of Return helps companies see how well a project is going in terms of profitability while taking into account returns on investments over a certain period. It offers a solid way of measuring financial performance for different projects and investments. Any asset that has a cost to purchase and will produce income at some point in the future, from selling or otherwise, has a calculable rate of return.

- Accounting Rate of Return (ARR) is a formula used to calculate the net income expected from an investment or asset compared to the initial cost of investment.

- Businesses generally utilize ARR to compare several projects and ascertain the expected rate of return for each one.

- AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining.

- For example, you invest 1,000 dollars for a big company and 20 days later you get 300 dollars as revenue.

Discover Wealth Management Solutions Near You

While it can be used to swiftly determine an investment’s profitability, ARR has certain limitations. The calculation of ARR requires finding the average profit and average book values over the investment period. Whereas average profit is fairly simple to calculate, there are several ways to calculate the average book value of investment. However, it is preferable to evaluate investments based on theoretically superior appraisal methods such as NPV and IRR due to the limitations of ARR discussed below. Based on the below information, you are required to calculate the accounting rate of return, assuming a 20% tax rate. This is a solid tool for evaluating financial performance and it can be applied across multiple industries and businesses that take on projects with varying degrees of risk.

If you’re making long-term investments, it’s important that you have a healthy cash flow to deal with any unforeseen events. Find out how GoCardless can help you with ad hoc payments or recurring payments. Average Annual Profit is the total annual profit of the projects divided by the project terms, it is allowed to deduct the depreciation expense. Recent FFM exam sittings have shown that candidates are struggling with the concept of the accounting rate of return and this article aims to help candidates with this topic. As the ARR exceeds the target return on investment, the project should be accepted. The initial cost of the project shall be $100 million comprising $60 million for capital expenditure and $40 million for working capital requirements.

This is when it is compared to the initial average capital cost of the investment. In today’s fast-paced corporate world, using technology to expedite financial procedures and make better decisions is critical. HighRadius provides cutting-edge solutions that enable finance professionals to streamline corporate operations, reduce risks, and generate long-term growth. According to accounting rate of return method, the Fine Clothing Factory should purchases the machine because its estimated accounting rate of return is 17.14% which is greater than the management’s desired rate of return of 15%. Candidates need to be able to calculate the accounting rate of return, and assess its usefulness as an investment appraisal method.

The required rate of return (RRR), or the hurdle rate, is the minimum return an investor would accept for an investment or project that compensates them for a given level of risk. It is calculated using the dividend discount compare economic cost and accounting cost model, which accounts for stock price changes, or the capital asset pricing model, which compares returns to the market. It is a useful tool for evaluating financial performance, as well as personal finance.

The accounting rate of return is a capital budgeting metric to calculate an investment’s profitability. Businesses use ARR to compare multiple projects to determine each endeavor’s expected rate of return or to help decide on an investment or an acquisition. To find this, the profit for the whole project needs to be calculated, which is then divided by the number of years for which the project is running (in this case five years). Since ARR is based solely on accounting profits, ignoring the time value of money, it may not accurately project a particular investment’s true profitability or actual economic value. In addition, ARR does not account for the cash flow timing, which is a critical component of gauging financial sustainability. The accounting rate of return (ARR) is a formula that shows the percentage rate of return that is expected on an asset or investment.

Trả lời